Company News

The movie Back to the Future Part II sent Marty McFly, his girlfriend Jennifer and Doc Brown from 1985 to October 21, 2015. Now that their fictional future has arrived, let’s see which promised technology predictions came true. And a few that didn’t.

Zip up your auto-fit, self-drying jacket… The future is here.

HOVERBOARD

Unfortunately, hoverboards don’t actually exist… yet. But for tech that’s cool and floats like Marty’s levitating skateboard deck, check out drones. From small toys that roll across the floor, to quadcopters complete with gimbal-mounted 4K cameras and GPS, drones are here and getting better all the time.

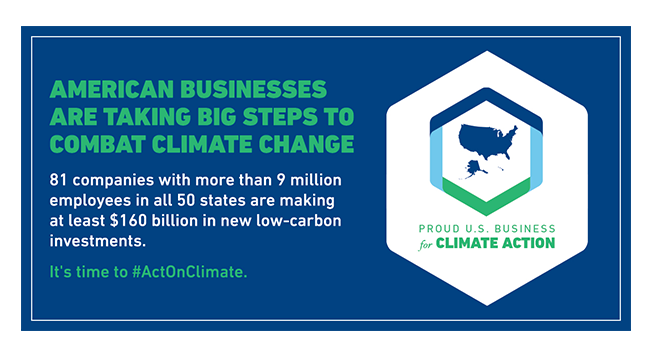

Today we are proud that Best Buy is joining other leading U.S. companies in signing the American Business Act Pledge on Climate Change.

This is an historic moment for Best Buy. In our pledge, we committed to further advancing our efforts toward addressing this global challenge. Here’s what we said:

- We will reduce our own carbon emissions by 45 percent by 2020 from operational reductions and renewable sourcing. This science-based goal builds on our 2014 achievement of a 26 percent reduction in carbon emissions within our operations.

Photo courtesy of Hao Zeng

A few weeks ago, I announced my new collection of accessories for smartphones, tablets and laptops exclusively for Best Buy. I’m excited to share they have now arrived in stores!

So how did this partnership come to be? No one knows technology and the accessories you need for it like Best Buy, and I know how tricky it can be to find accessories that are both fashionable and functional. So it made sense for us to collaborate.

The goal was bridging the digital gap for families, but the theme was empowerment at Dorsey High School in Los Angeles on Sept. 19.

Several families, with help from Best Buy employees, were trained on basic computer skills and went home with something they didn’t have before – Internet connectivity and a computer.

Best Buy partnered with OurCycle LA, a City of Los Angeles digital inclusion pilot program geared at providing free refurbished computers and training to low-income families in Los Angeles.

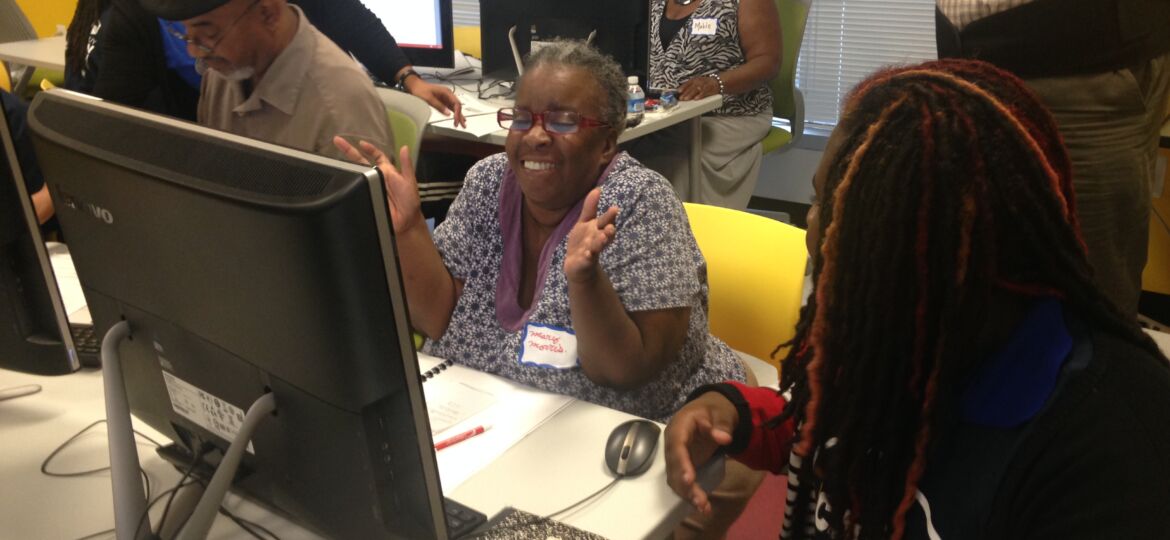

Best Buy recently joined forces with two nonprofits in Washington, D.C., to help older adults connect with technology — often for the very first time — with teen mentors by their side.

The company, along with Cyber-Seniors and the Boys and Girls Club of Greater Washington, brought together 30 teens and 23 seniors at the Best Buy Teen Tech Center. The event included a reception and demonstrations led by Best Buy and Geek Squad trainers. Several other employees from area stores volunteered to help out, too, as the event happened during the Best Buy Week of Service.

MINNEAPOLIS – Sept. 15, 2015 – Best Buy Co., Inc. announced today the appointment of Karen McLoughlin to its Board of Directors. McLoughlin is the chief financial officer at Cognizant Technology Solutions (Nasdaq: CTSH), a Fortune 500 company and leading provider of information technology, business process and consulting services.

McLoughlin, 50, joined Cognizant in 2003 and has spearheaded several critical transformation initiatives during her time with the company. She has been the chief financial officer since 2012, overseeing the company’s worldwide accounting and controllership, enterprise risk management, financial planning and analysis, internal audit, investor relations, tax and treasury functions.